Long Calendar Spread

Long Calendar Spread - I execute this strategy when: A long calendar spread is a good strategy to use when you expect. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration dates: Trading in low implied volatility environments

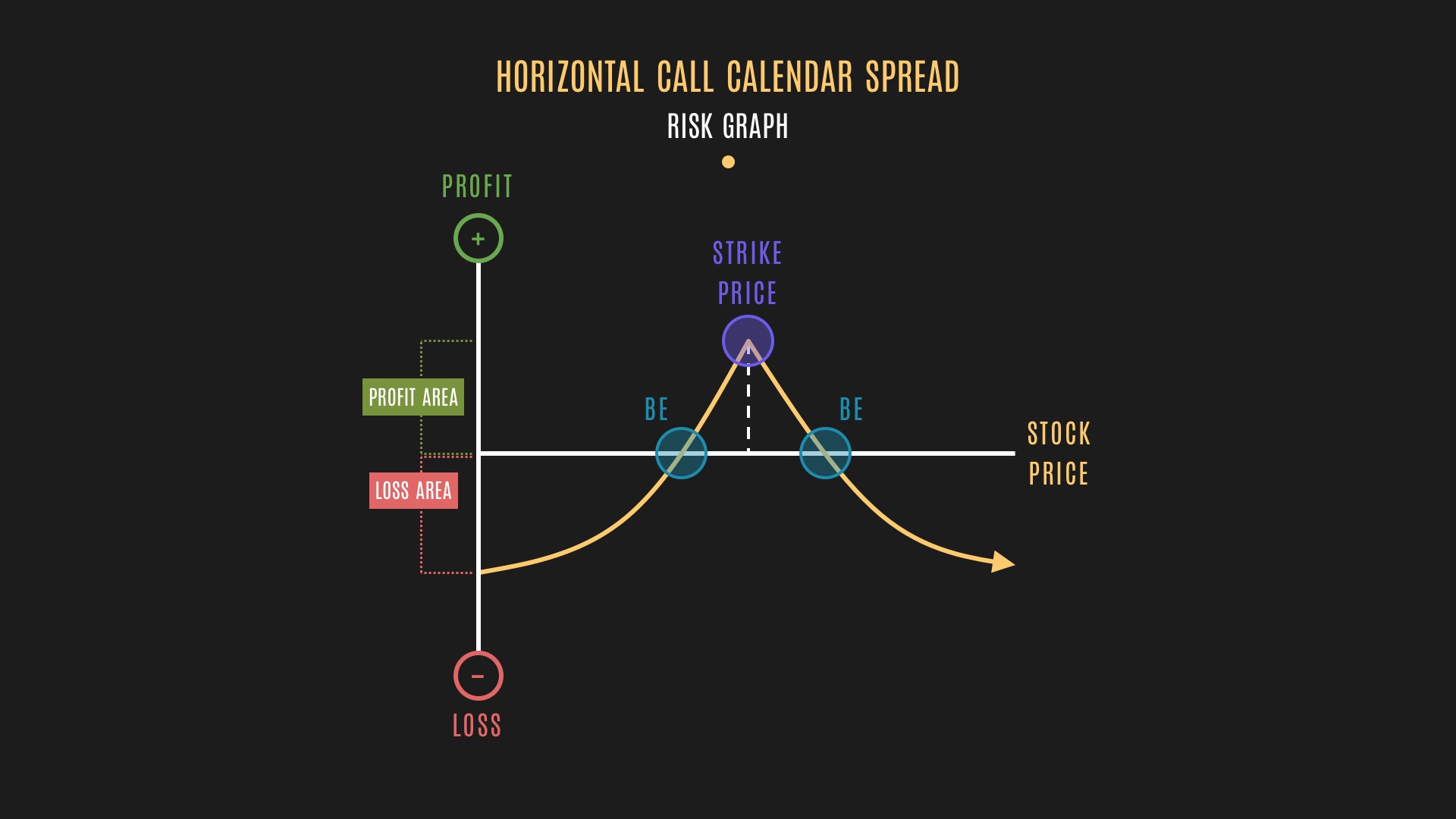

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Anticipating sideways price movement in the underlying asset; A long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration dates:

A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. A long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration dates: Calendar spreads are a great way to combine.

A long calendar spread is a good strategy to use when you expect. A long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration dates: The short option expires sooner than the long option of the same type. I execute this strategy when: A long calendar call spread is seasoned option strategy where.

A long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration dates: Anticipating sideways price movement in the underlying asset; Trading in low implied volatility environments I execute this strategy when: Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position.

But, the underlying asset and strike prices will be identical in each position. I execute this strategy when: A long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration dates: A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price.

Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. The short option expires sooner than the long option of the same type. Anticipating sideways price movement in the underlying asset; But, the underlying asset and strike prices will be identical in each position. A long calendar spread with calls.

Long Calendar Spread - The short option expires sooner than the long option of the same type. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Anticipating sideways price movement in the underlying asset; Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position.

Anticipating sideways price movement in the underlying asset; But, the underlying asset and strike prices will be identical in each position. A long calendar spread is a good strategy to use when you expect. The short option expires sooner than the long option of the same type. A long calendar spread is a strategy where two options that were entered into simultaneously, have different expiration dates:

A Long Calendar Spread Is A Good Strategy To Use When You Expect.

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. But, the underlying asset and strike prices will be identical in each position.

A Long Calendar Spread Is A Strategy Where Two Options That Were Entered Into Simultaneously, Have Different Expiration Dates:

Trading in low implied volatility environments A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Anticipating sideways price movement in the underlying asset; The short option expires sooner than the long option of the same type.